Doing your own bookkeeping can seem like a daunting task, but it is important to keep track of your business finances. In this article, we will show you how to do bookkeeping for small businesses.

We will cover the basics of bookkeeping and give you some tips on how to stay organized. So, whether you are just starting out or have been running your business for a while, read on to learn more about bookkeeping.

How to Organize Your Bookkeeping for a Small Business

Bookkeeping is the process of recording, classifying, and summarizing financial transactions to provide information that is useful in making business decisions.

The transactions recorded in bookkeeping include purchases, sales, receipts, and payments by an individual or organization.

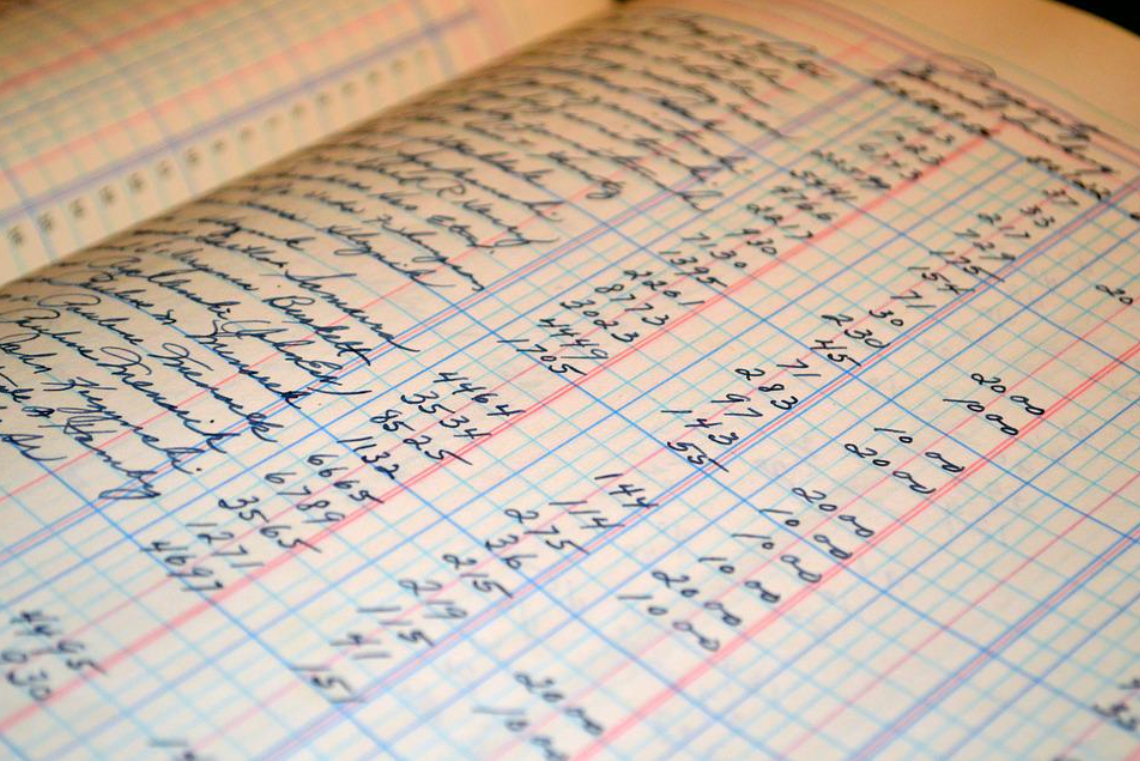

There are two types of bookkeeping: manual and computerized. Manual bookkeeping is the traditional method of recording transactions in a ledger. This method is still used by some small businesses, but it can be time-consuming and prone to error.

Computerized bookkeeping is the more modern approach, and involves using software to record and track transactions. This method is faster and more accurate, and is the preferred method for most businesses.

To get started with bookkeeping, you will need to set up a system for tracking your transactions. This can be done using a ledger, software program, or online app. Once you have chosen a method, you will need to start recording your transactions.

For each transaction, you will need to record the date, amount, and type of transaction. You will also need to keep track of your income and expenses, so that you can see where your money is going.

What are the Different Types of Bookkeeping?

There are many different types of bookkeeping software available, and it can be difficult to choose the right one for your business. The most important thing to consider is what type of features you need.

Some software programs are very basic, while others offer a wide range of features. You should also consider the cost of the software, and whether you need a subscription or a one-time purchase.

The most popular type of bookkeeping software is QuickBooks. QuickBooks is a comprehensive program that offers a wide range of features, including invoicing, tracking expenses, and preparing tax returns.

QuickBooks is available in both desktop and online versions. The desktop version is more expensive, but it offers more features. The online version is less expensive, but it requires an internet connection to use.

Another popular type of bookkeeping software is Sage 50. Sage 50 is a comprehensive program that offers a wide range of features, including invoicing, tracking expenses, and preparing tax returns.

Sage 50 is available in both desktop and online versions. The desktop version is more expensive, but it offers more features. The online version is less expensive, but it requires an internet connection to use.

Xero is a cloud-based bookkeeping software that offers a wide range of features, including invoicing, tracking expenses, and preparing tax returns. Xero is available in both monthly and yearly subscription plans.

The monthly subscription plan is less expensive, but it requires an internet connection to use.

Wave is a free, cloud-based bookkeeping software that offers basic features, such as invoicing and tracking expenses.

Wave does not offer as many features as some of the other software programs, but it is a good option for businesses that have a small number of transactions.

How to Keep Records of Expenses and Revenue

When it comes to bookkeeping, there are two main types of records that small businesses need to keep track of: expenses and revenue. Revenue includes all of the money that comes into your business, such as sales, interest, and investments.

Expenses include all of the money that you spend on running your business, such as rent, utilities, and inventory.

It is important to keep track of both your expenses and revenue, because they will help you make sound business decisions. For example, if you see that your expenses are higher than your revenue, you may need to cut back on some of your costs.

On the other hand, if you see that your revenue is higher than your expenses, you may be able to reinvest that money back into your business.

5 Tips to Make Bookkeeping Easier

Write an article on how to make bookkeeping easier for your small business. Here are 5 tips that will help you get started:

- Use a ledger or software program to track your transactions.

- Record the date, amount, and type of each transaction.

- Keep track of your income and expenses.

- Choose the right bookkeeping software for your business.

- Stay organized and keep accurate records.

Bookkeeping is an important task for any small business, but it doesn’t have to be difficult. By following these tips, you can make bookkeeping easy and stress-free.

How to make bookkeeping less daunting for small business owners

Making bookkeeping less daunting for small business owners is the goal of this article. It is a process that can be overwhelming for those who are just starting out, but with the right tools and some helpful advice, it can be manageable.

The first step is to create a system that works for you. This may involve using a ledger or software program to track your transactions. You will also need to record the date, amount, and type of each transaction.

Keeping track of your income and expenses is essential to bookkeeping. Finally, you will need to choose the right bookkeeping software for your business. By following these tips, you can make bookkeeping less daunting for small business owners.

What are the 3 Most Important things to keep track of in your bookkeeping?

These three tips will help you stay organized and keep accurate records:

- Keep track of your income and expenses. This will help you make sound business decisions.

- Use a ledger or software program to track your transactions. This will help you stay organized and efficient.

- Choose the right bookkeeping software for your business. This will help you save time and money. By following these tips, you can make bookkeeping less daunting for small business owners.

Quick Links

- Most Profitable Online Businesses

- How To Start A Freelance Business

- Reasons Your Business Needs Amazon PPC Automation Software

Conclusion- How To Do Bookkeeping For Small Business 2024

Bookkeeping is an important part of any small business. It can be daunting, but it doesn’t have to be. We hope this guide has helped you understand the basics of bookkeeping and how to get started.

We want your small business to thrive and that means providing you with the best resources possible.